On August 19, the U.S. FDA opted to delay full approval for Liquidia Corporation‘s inhaled blood pressure drug targeting lung diseases. The company had hoped for provisional clearance. This decision caused a sharp drop in Liquidia’s stock, with shares plummeting by nearly 40% in premarket trading.

Liquidia must wait until the exclusivity rights held by United Therapeutics for their inhalable drug, Tyvaso DPI, expire in 2025. Only after that it can obtain full approval for its drug, Yutrepia. It is designed to treat pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD).

Liquidia intends to contest the exclusivity granted to Tyvaso DPI. The exclusive rights currently cover any dry-powder formulation of treprostinil used for treating PAH and PH-ILD.

The FDA’s decision represents yet another obstacle in Liquidia’s efforts to bring Yutrepia to market. The FDA granted the drug a tentative approval for PAH back in 2021. However, a patent dispute with United Therapeutics has kept it off the market.

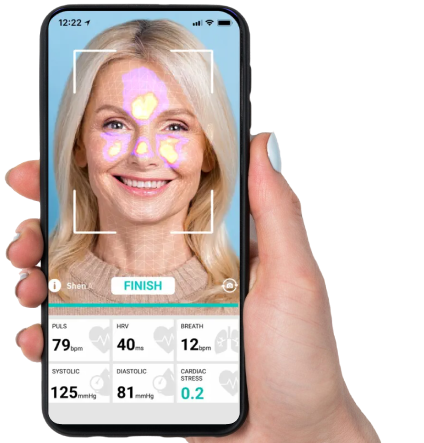

Both Yutrepia and Tyvaso DPI offer the convenience of being administered through compact, handheld devices. It is a significant improvement over the bulkier nebulizers traditionally used for such treatments.

In its latest move, the FDA once again gave tentative approval to Yutrepia for both PAH and PH-ILD, following a review that extended into January of this year. According to TD Cowen analyst Joseph Thome, this outcome maintains Tyvaso DPI’s exclusive position in the market for the foreseeable future.

Following the announcement, United Therapeutics saw a 6.7% rise in its share price, while Liquidia’s stock fell by over 38%.

The recent developments concerning Liquidia Corporation’s drug Yutrepia are a culmination of a complex series of regulatory, legal, and commercial challenges that have been ongoing for several years.

Inhaled blood pressure drugs

Yutrepia, developed by Liquidia, is an inhalable dry powder formulation of treprostinil. It is intended for the treatment of pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD). Its primary competitor is Tyvaso DPI. It is a similar dry powder inhalation drug developed by United Therapeutics, which has been a major player in this market.

The convenience of these inhalable forms of treprostinil, compared to traditional nebulized treatments, has made them attractive options for patients, as they are easier to administer and more portable.

FDA’s Tentative Approvals

Yutrepia initially received tentative FDA approval in 2021 for PAH, but Liquidia could not proceed with marketing the drug due to ongoing patent litigation with United Therapeutics. In August 2023, the FDA granted another tentative approval, this time also covering PH-ILD, but full approval remains contingent on the expiration of United Therapeutics’ regulatory exclusivity for Tyvaso DPI in May 2025.

This exclusivity, granted to Tyvaso DPI in 2022, effectively blocks any competing products (like Yutrepia) from being fully approved and marketed until it expires. Liquidia has indicated that it will challenge this exclusivity in court to expedite Yutrepia’s entry into the market.

Legal Battles

The ongoing legal disputes between Liquidia and United Therapeutics have been central to the delay in Yutrepia’s final approval. United Therapeutics has filed multiple lawsuits and motions attempting to block Yutrepia’s approval and market entry, citing patent infringements and regulatory disputes. However, recent court decisions have generally favored Liquidia, lifting injunctions and rejecting United’s attempts to halt FDA actions, potentially paving the way for Yutrepia’s future approval once exclusivity issues are resolved.

Market Impact

The delay in full approval for Yutrepia has had significant financial consequences for Liquidia, with its shares dropping sharply following the FDA’s decision to delay approval until 2025. Meanwhile, United Therapeutics’ stock rose, reflecting investor confidence in Tyvaso DPI’s continued market dominance until Yutrepia can potentially compete.

Inhalable drugs like Yutrepia and Tyvaso DPI represent an evolving frontier in treating pulmonary hypertension, offering more patient-friendly options compared to older delivery methods. However, the intense competition and legal maneuvering in this space underscore the high stakes involved in gaining and maintaining market share in this lucrative segment.

This situation remains dynamic, with ongoing litigation and potential regulatory developments that could alter the competitive landscape before 2025